Durable Asset Tracking Labels and Services

Application-specific labels, identification tags and barcodes.

Custom Labels For Every Application

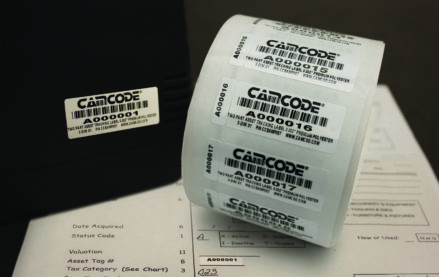

Get durable, customized asset labels that remain scannable and affixed to your asset through its lifecycle, integrate with any software or scanner, and are delivered to facilitate efficient and accurate installation.

Designed for Durability

Avoid repurchase, replacement, and re-installation by investing in durable asset labels built to last.

Tested in Every Environment

From outer space to off-shore oil rigs to the gas meter outside your house, our labels have been trusted in the harshest operating environments since 1950.

Software Compatible

Link your assets to any asset tracking software and scanner system without worry. Our durable asset labels support linear, 2D, QR and any other barcode symbology.

100% Customizable

Whether you need labels for warehouse racks or fighter jets, we will work with you to design and manufacture the right label, data structure and attachment method for your application.

Ready to Use

Our labels come ready to attach ~ whether that’s with the right adhesive for your surface, hang-ties or metal rivets; we make installation easy.

Dedicated Customer Service

When you reach out, you’ll talk to a real human with deep barcoding application experience. Our U.S.-based customer service teams are here to help you.

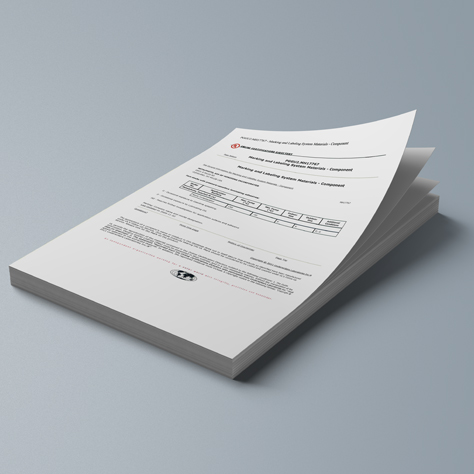

Labels Are Complex. We Make Them Simple

We don’t just make labels. We design, develop, manufacture, test, ship, and, if you like, even install — supporting you at every stage of asset or location tracking.

Find the Right Labels for What You Need

Don’t see your specific need addressed? Reach out to our team to explain what you need. Chances are, we can build it.

Experience the Difference the Right Label Makes

Durable barcode labels complete your asset management or warehouse management system and solidify the integrity of your asset register.

Increase Efficiencies

Improve Safety

Reduce Costs

Integrate Systems

Access Support

Improve Data Accuracy

What do our customers think?

Supermarket Chain Case Study

“We expect efficiency and data accuracy to increase dramatically.”

The barcodes are eliminating mistyped numbers and speeding up the time it takes to accurately manage and track our assets.

“We needed the ‘Swiss Army Knife’ of tags.”

“It was necessary to have an asset tag that could withstand the outdoor elements, yet was simple enough to meet basic tracking needs. We achieved both with Camcode’s asset tags.”

Get Support with Asset Management Services

Go beyond labels. Get the help you need.

Build a better asset management program with accurate data. We’ll help you get there. Ensure the integrity of your asset register with our value-added services. We’ll even help with label installation, so you can start seeing improvements as soon as possible. Camcode’s extensive collection of tailored services includes project management, data management, and uniquely engineered identification products to deliver a completely personalized asset tracking solution.

Discover New Insights With Our Resources

Get insight into asset management and tracking systems with our industry-leading resources.

Keep Operations Efficient with Facility Management Asset Tags

Find exactly what you need. And, if you don’t find it, build it with Camcode. Talk to our team today.