58 Top Government Accounting Resources: Articles, Guides, Videos and More for Navigating Complex Government Accounting, GASB Standards and Fiscal Reporting

Governmental accounting and reporting is complex and changes rapidly. Government accountants and auditors are responsible for staying current with the latest developments at the Government Accountability Office (GAO), Office of Management and Budget (OMB), American Institute of CPAs (AICPA), and Governmental Accounting Standards Board (GASB) to ensure that their accounting and auditing skills are sharp enough to meet current requirements and comply with Governmental Generally Accepted Accounting Principles (GAAP). Government accountants and auditors also need to be prepared for significant changes in the future, as some requirements and regulations are put out in advance of their implementation date.

That’s why at Camcode, we have gathered this list of the top government accounting resources available today. We have searched for current and highly-regarded government accounting resources from experts, thought leaders, and accounting masterminds to help you learn and understand more about GASB standards, the new OMB Uniform Grant guidance, modified accrual accounting for governmental entities, and so much more relating to the field of governmental accounting. Our resources include articles and blogs, eBooks and guides, journals, conferences, and webinars, among others, to give you access to the information you need to stay current in today’s ever-changing government accounting environment.

While we have listed our top government accounting resources below in no particular order, we have included a table of contents to make it easier for you to jump to the resource categories that most interest you.

Jump to:

Articles and Blogs

1. U.S. Governmental Accounting Board Takes on Tax Abatement Programs

@Reuters

In this government accounting article for Reuters, Lisa Lambert examines a proposal from the Governmental Accounting Standards Board (GASB) requiring U.S. state and local governments to disclose how much revenue they lose through tax breaks for economic development projects. The board cited difficulty in discerning the magnitude and nature of effects on governmental finances and the ability to raise revenue as the reason behind the proposal.

Three key points we like from U.S. Governmental Accounting Board Takes on Tax Abatement Programs:

Cost: FREE

2. New Mexico’s $100 Million Accounting Error

@business

@jennoldham

Bloomberg Business is known for delivering “the first word in business news.” In this government accounting article for Bloomberg Business, Jennifer Oldham examines the $100 million shortfall in New Mexico’s ledger, because of a new accounting system introduced in 2006. As a result of the error, Standard & Poor’s revised the state’s outlook to negative, due to the state’s cash management practices and dependence on energy.

Three key points we like from New Mexico’s $100 Million Accounting Error:

Cost: FREE

3. New Rule Could Require Governments to Report Tax Incentives as Lost Income

@GOVERNING

@LizFarmerTweets

Governing Magazine offers news and analysis of state and local government politics, policy, and management. Here, public finance writer Liz Farmer explains that an effort is underway “to make government tax subsidies more transparent,” as the GASB wants to make an accounting change to require reporting of tax incentives as lost income in annual financial reports.

Three key points we like from New Rule Could Require Governments to Report Tax Incentives as Lost Income:

Cost: FREE

4. Impact of GASB’s New Pension Rules on Government Bond Ratings

@pensionsnews

Pensions & Investments is a leading news and data source for everything related to retirement, including endowment, 401(k), and pensions. In this government accounting article, Mark Lasee and Marc Lieberman examine the impact of the GASB’s new pension reporting rules, effective June 15 and found in GASB Statements 67 and 68, which mandate that governmental balance sheets reflect unfunded pension liabilities.

Three key points we like from Impact of GASB’s New Pension Rules on Government Bond Ratings:

Cost: FREE

5. Fixing Public Sector Finances: The Accounting and Reporting Lever

@HarvardCorpGov

This article from the Harvard Law School Program on Corporate Governance, directed by Lucian Bebchuk, was written by Holger Spamann, assistant professor at Harvard Law School. Spamann based his post on the article Fixing Public Sector Finances: The Accounting and Reporting Lever, published in the UCLA Law Review and co-authored by James Naughton of Kellogg School of Management and Spamann himself, which calls for fixing the ineffective financial reporting regime for public entities.

Three key points we like from Fixing Public Sector Finances: The Accounting and Reporting Lever:

Cost: FREE

6. Government GPS

@HHCPAs

Government GPS is the blog of Henry & Horne, LLP, Arizona’s largest locally-owned accounting firm that has provided professional services to the government industry for more than 55 years. The blog is an extensive government accounting resource, with posts covering accounting standards, best practices, GASB, GAAP, GFOA, and many other categories.

Three posts we like from Government GPS:

Cost: FREE

7. CRI CPA Blog

@CRIcpa

The CRI CPA Blog is the blog of Carr, Riggs & Ingram, whose CPAs and business consultants offer auditing, accounting, tax, forensic accounting, business consulting, and other services for governmental entities, publicly-traded companies, not-for-profit organizations, and other organizations. Their blog archives date to February 2011 and cover various industries and services. We have found their government accounting posts to be especially on trend.

Three posts we like from CRI CPA Blog:

Cost: FREE

8. Governmental Accounting & Management News

@heinfeldmeech

Heinfeld, Meech and Co., CPAs and Business Consultants, specializes in governmental and non-profit accounting, auditing, and consulting. Their blog delivers information to governmental entities on regulatory updates and compliance issues.

Three posts we like from Governmental Accounting & Management News:

Cost: FREE

9. Crawford & Associates Governmental Accounting Blog

Crawford & Associates is dedicated to “promoting public accountability and stewardship of public resources.” They are leaders in state and local government financial management, and they use their blog to share information about the latest developments in that arena.

Three posts we like from Crawford & Associates Governmental Accounting Blog:

Cost: FREE

eBooks and Guides

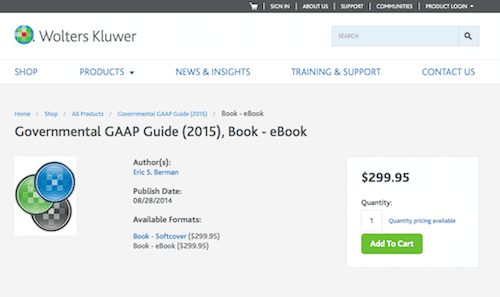

10. Governmental GAAP Guide (2015)

@WKTAAUS

Wolters Kluwer Tax and Accounting delivers insightful, industry-leading resources and step-by-step guidance on tax and accounting issues. Their eBook, Governmental GAAP Guide (2015), is written by Eric S. Berman, a CPA with more than 20 years of governmental accounting and auditing experience.

Three key topics we like from Governmental GAAP Guide (2015):

Cost: $299.95

11. Governmental Accounting Made Easy

@wileytweets

Author Warren Ruppel is a leading authority on governmental accounting. In Governmental Accounting Made Easy, an eBook, Ruppel offers practical information in easily understood language. He explains accounting rules in terms that even those who do not have a good handle on accounting principles and financial reporting can understand to help them better fulfill their managerial and fiduciary duties.

Three topics we like from Governmental Accounting Made Easy:

Cost: $25.99

12. Applying Government Accounting Principles

Written by Mortimer A. Dittenhofer and Edward W. Stepnick, this government accounting eBook, available from Google Books, covers nearly every aspect of accounting and financial reporting for state and local governments, plus federal government programs. The eBook features analysis and clear text, along with hundreds of practical work aids, covering a variety of government accounting topics.

Three key topics we like from Applying Government Accounting Principles:

Cost: $339.20

13. Wiley GAAP for Governments 2015: Interpretation and Application of Generally Accepted Accounting Principles for State and Local Governments

@wileytweets

Wiley GAAP for Governments 2015 is Warren Ruppel’s eBook that provides the latest GAAP information. Designed specifically for government entities, the book focuses on practical application and includes up-to-date implementation information and explanations for government accounting.

Three key topics we like from Wiley GAAP for Governments 2015:

Cost: $84.99

14. Governmental Accounting: Fundamental Principles (Portfolio 5140)

@BloombergBNA

A wholly-owned subsidiary of Bloomberg, Bloomberg BNA is a leading source of legal, regulatory, and business information for professionals. A part of the Accounting Policy and Practice Series, Governmental Accounting: Fundamental Principles provides a comprehensive discussion on the fundamentals of governmental accounting.

Three key topics we like from Governmental Accounting: Fundamental Principles (Portfolio 5140):

Cost:

15. Government Accounting for Fixed Assets: GASB Guidelines for Your Organization

@SageNAmerica

Sage provides this comprehensive guide to GASB guidelines to aid agencies in navigating the complex accounting rules and complying with reporting and depreciation requirements. GASB Statements 34, 42, and 51 are discussed in detail.

Three key points we like from Government Accounting for Fixed Assets: GASB Guidelines for Your Organization:

Cost: FREE

Journals, White Papers, and Other Publications

16. Journal of Accounting Education, Special Issue: Governmental and Not-for-Profit Accounting Education

@sciencedirect

Science Direct offers more than 2,500 peer-reviewed journals and 33,000 books, including the Journal of Accounting Education. The special issue concerning governmental and not-for-profit accounting education features original research articles covering U.S. government spending, the national debt, and the role of accounting educators, intentional learning for students in governmental and non-profit accounting, and more.

Three key points we like from Journal of Accounting Education, Special Issue: Governmental and Not-for-Profit Accounting Education:

Cost: Articles available for purchase as PDF: $19.95 each

17. Journal of Governmental & Nonprofit Accounting

@aaahq

Founded in 1916, the American Accounting Association (AAA) promotes “worldwide excellence in accounting education, research, and practice.” Published by the Government and Nonprofit (GNP) section of the AAA, the Journal of Governmental & Nonprofit Accounting (JOGNA) is a publication that delivers timely information and ideas to the academic and practice communities.

Three articles we like from Journal of Governmental & Nonprofit Accounting:

Cost: FREE

18. AICPA Governmental Audit and Accounting Publications

@AICPANews

The American Institute of CPAs (AICPA) offers several publications to assist governmental and not-for-profit accounting and auditing professionals. Their collection of government accounting resources includes audit and accounting guides, audit risk alerts, and other helpful publications.

Three publications we like from AICPA Governmental Audit and Accounting Publications:

Cost: Prices vary by publication; Contact for price

19. GFOA Governmental Accounting, Auditing, and Financial Reporting Publications

@GFOA

The Government Finance Officers Association (GFOA) seeks to enhance and promote the professional management of governments for the public benefit. They offer several governmental accounting, auditing, and financial reporting publications online, including an elected official’s guide, a GAAFT supplement, a guide to evaluating internal controls for a local government manager, and more.

Three publications we like from GFOA Governmental Accounting, Auditing, and Financial Reporting Publications:

Cost: Prices vary by publication; Contact for price

20. GASB White Paper: Why Governmental Accounting and Financial Reporting Is – And Should Be – Different

@FAFNorwalk

The GASB, in independent organization, establishes and improves standards and accounting and financial reporting for U.S. state and local government. Their white paper, Why Governmental Accounting and Financial Reporting Is – And Should Be – Different, is highly regarded as one of the most important governmental accounting resources.

Three key points we like from GASB White Paper: Why Governmental Accounting and Financial Reporting Is – And Should Be – Different:

Cost: FREE

21. Back to Basics: An Overview of Governmental Accounting and Financial Reporting

@GFOA

Back to Basics: An Overview of Governmental Accounting and Financial Reporting was written by CPFO Michael A. Genito, commissioner of finance for the City of White Plains, NY and former GFOA Executive Board member. Genito explains his stance that “everyone involved in overseeing or managing government operations needs to understand the basics of public-sector accounting and financial reporting” and offers a straightforward look into governmental accounting and financial reporting to help readers understand those basics.

Three key ideas we like from Back to Basics: An Overview of Governmental Accounting and Financial Reporting:

Cost: FREE

22. Will GASB 34 Induce Changes In Local Government Forecasting Practice? A Preliminary Investigation

Howard A. Frank, Gerasimos A. Gianakis, and Clifford P. McCue, authors of this report, conducted a national survey of local and county finance officers in 2005 to determine the likely impact and outcomes from the GASB 34 standards in theory vs. practice. On the surface, GASB 34 is perceived to possibly “induce an upgrading of local sector forecasting capacity as well as a reduction of tolerated forecast error,” and the survey results indicate that “respondents with graduate degrees who work in offices with forecasting software may respond to GASB 34 implementation in a manner consistent with this expectation.” However, others may be unlikely to “view the standard as a cue to enhance their forecast capacity,” in the early stages of the GASB 34 rollout.

Three key points we like from Will GASB 34 Induce Changes In Local Government Forecasting Practice? A Preliminary Investigation:

23. Asset Management and GASB 34 – Challenge or Opportunity?

@FAFNorwalk

Daniel Dornan, a vice president at Infrastructure Management Group, Inc., discusses the impacts of the introduction of GASB 34 requirements, which require state and local governments to include the value of public infrastructure, including assets such as roads and bridges, in their annual financial statements. According to Dornan, the accounting rule is likely to force state and local governments to allocate more funding for infrastructure preservation, and may introduce significant changes in the way infrastructure is financed and managed.

Three key points we like from Asset Management and GASB 34 – Challenge or Opportunity?:

Cost: FREE

24. Asset Management and G.A.S.B. Statement 34: The Basics of Managing Your Infrastructure

Nicholas T. Nguyen, a Senior Associate at LA Consulting, Inc., provides a comprehensive overview of asset management within the context of GASB Statement 34. Nguyen points out, “The ultimate goal to is maximize your returns over the long run by careful management of your infrastructure, focusing on the elements that will best enhance the returns.” Nguyen shares insights on what GASB Statement 34 means for agencies, including a discussion of to what extent agencies should comply with the rule.

Three key points we like from Asset Management and G.A.S.B. Statement 34: The Basics of Managing Your Infrastructure:

Cost: FREE

25. Primer: GASB 34

@USDOT

The U.S. Department of Transportation provides this FHWA Primer on the Governmental Accounting Standards Board’s Statement 34: Basic Financial Statements, including a management discussion and analysis, for state and local governments. This comprehensive primer on GASB 34 includes a discussion of infrastructure requirements, information on reporting infrastructure cost of use, implementation, and asset management information.

Three key points we like from Primer: GASB 34:

Cost: FREE

Conferences, Forums, and Symposiums

26. AICPA Governmental Accounting and Auditing Update Conference (GAAC)

@AICPANews

August 10-11

Washington, DC

September 29-30

San Diego, CA

The AICPA Governmental Accounting and Auditing Update Conference (GAAC) is offered in two locations – Washington, DC, and San Diego in September. This governmental accounting conference offers in-depth training specific to federal, state, and local government areas. Attendees will hear from influential policymakers and government officials, who will provide insight on trending issues and new and pending standards. Network with peers and governmental experts in person. If you can’t attend in person, you also can attend the Virtual Conference remotely, in real time.

Cost to attend:

27. AGA PDT 2015

@AGACGFM

July 12-15

Nashville, TN

The Association of Government Accountants (AGA) is a member organization for financial professionals in government. Their training events, professional certification, publications, and ongoing educational opportunities and events help members build skills to advance their careers. That’s why PDT 2015, AGA’s Professional Development Training, is one of the must-attend annual governmental accounting events. With up to 24 CPE hours available to attendees, PDT joins top federal, state, and local government officials, plus those from academia and the private sector, for nearly four days of valuable training and networking.

Cost to attend:

28. FICPA State and Local Government Accounting Conference Simulcast

@FICPA

August 27-28

Orlando, FL

The Florida Institute of Certified Public Accountants is a premier professional organization representing Florida’s CPAs. They offer the the State and Local Government Accounting Conference Simulcast, which is dedicated to the issues of CPAs in state and local government. Attendees will learn the changes for auditing under the new OMB Uniform Grant guidance, the necessary components of implementing GASB pension standards No. 68 and 71, and much more over two days. The conference qualified for 14 Accounting and Auditing CPE credits and 2 Technical Business CPE credits.

Cost to attend:

29. NSAA Annual Conference

June 10-12

Little Rock, Arkansas

The National State Auditors Association (NSAA) is a secretariat managed by the National Association of State Auditors, Comptrollers, and Treasurers (NASACT). Held each June, the NSAA Annual Conference is the association’s premier event, designed to provide ample opportunities for state auditors to network and hear industry leaders speak about current and emerging issues in governmental accounting and auditing. Featuring two and a half days of technical sessions, the NSAA Annual Conference gives attendees the opportunity to participate in CPE-accredited general sessions. The conference also features multiple peer networking opportunities and an NSAA business meeting.

Cost to attend:

30. 2015 NASBO Annual Meeting

@NASBO

August 9-12

Stowe, VT

The National Association of State Budget Officers (NASBO) will hold its 2015 annual meeting in Stowe, Vermont. Hosted by the Vermont Department of Finance & Management, the 2015 NASBO Annual Meeting features expert speakers on the national economy, state revenues, healthcare, and more. The 2015 NASBO Annual Meeting is open to all state budget offers, budget analysts, and support staff, as well as representatives from the federal government, state agencies, associations, educational institutions, and non-profits with an interest in state budget issues, including governmental accounting and auditing.

Cost to attend:

31. NASACT Annual Conference

August 22-26

Chicago, IL

This year marks NASACT’s 100th anniversary conference, which is the association’s premier event. Held each August, the NASACT Annual Conference provides state auditors, state comptrollers, and state treasurers to network and here industry leaders speak on trending issues. CPE-accredited general sessions and breakout sessions allow NASACT’s members to address the specific concerns of their constituents. Keynote speakers will include Dr. Al Gini, Professor of Business Ethics and Chair of the Department of Management, School of Business Administration at Loyola University; Ron Elving, Senior Washington Editor and Correspondent, NPR News; Gene Dorado, U.S. Comptroller General; and Cynthia Storer, featured analyst in the HBO documentary on the hunt for Osama Bin Laden.

Cost to attend:

32. 2015 Government Accounting & Auditing Conference

@LouisianaCPAs

November 9-10

Lafayette, LA

The Society of Louisiana Certified Public Accountants (LCPA) is the premier organization for CPAs in Louisiana, and it supports members through education, advocacy, and networking opportunities. Their 2015 Government Accounting & Auditing Conference will take place in November in Lafayette, and is one of their top annual conferences, providing the latest news and information on government accounting and auditing. Check back for the full agenda, which should be available soon.

Cost to attend:

33. GFOA Annual Conference 2016

@GFOA

May 22-25, 2016

Toronto, ON, Canada

The Government Finance Officers Association’s Annual Conference will be held in Toronto, Canada, in May of 2016. Join thousands of public finance professionals from across the U.S. and Canada at this three-day conference to share ideas, develop technical and managerial skills, view new products, and network with peers while learning from recognized leaders in the government finance profession. Concurrent sessions will be offered to address current issues in government finance, government accounting, and government auditing.

Cost to attend: Contact for registration price

34. CalCPA Governmental Accounting and Auditing Conference

@Cal_CPA

Date TBD

Location TBD

Typically held in May, the CalCPA Governmental Accounting and Auditing Conference is CalCPA Education Foundation’s annual update for CPAs and financial professionals who work in governmental accounting and auditing. Hear from leaders in the sector and get updates on the most important current and proposed GASB standards. Be sure to mark you calendar for this government accounting conference and check back as details for the 2016 event are released.

Cost to attend: Contact for registration price

35. MSCPA Government Accounting & Auditing Conference

@MSCPACPE

Date TBD

Location TBD

The Massachusetts Society of Certified Public Accountants (MSCPA) is the state’s premier professional organization, counting more than 11,000 members in public accounting, industry and business, government, and education. The Society provides advocacy, continuing professional education, peer review, membership, communications, and academic and career development departments to help its members learn, connect, and excel in accounting. The MSCPA Government Accounting & Auditing Conference typically is held in June and features speakers who are among some of the top experts in government accounting and auditing. Be sure to check back for more details as the 2016 event is finalized.

Cost to attend: Contact for registration price

36. ASCPA 28th Annual Governmental Accounting & Auditing Forum

@alabamacpa

December 2-3

Montgomery, AL

The Alabama Society of CPAs (ASCPA) promotes the professional interests of Alabama’s CPAs. Their annual governmental accounting and auditing forum provides 16 hours of accounting and auditing education from premier speakers. With a focus on accounting and auditing for government and not-for-profit entities, the forum is an important event for accountants and CPAs in city and state government positions, as well as for the professionals who audit them.

Cost to attend:

37. VLCT Governmental Accounting & Auditing Symposium

@VLCTAdvocacy

June 16, 2015

Montpelier, VT

The Vermont League of Cities and Towns (VLCT) Governmental Accounting & Auditing Symposium is a one-day annual event that delivers a comprehensive series of educational sessions about governmental accounting and auditing. Presented by CPAs and state and local government officials, the symposium highlights important updates and information from the GASB, along with other legislative changes and new requirements concerning government accounting and auditing. Attendees have the ability to earn CPE credits for attendance.

Cost to attend:

Organizations

38. Governmental Accounting Standards Board (GASB)

@FAFNorwalk

An independent organization, the Governmental Accounting Standards Board (GASB) seeks to establish and improve standards of accounting and financial reporting for U.S. state and local government. GASB was established in 1984 by the Financial Accounting Foundation (FAF) and is recognized by governments, the accounting industry, and capital markets as the official source of generally accepted accounting principles (GAAP) for state and local governments. The GASB website is an important government accounting resource, offering links to standards and guidance, projects, meetings, and much more.

Three key resources we like from Governmental Accounting Standards Board:

Cost: Pricing varies by resource; Contact for a price

39. Association of Government Accountants (AGA)

@AGACGFM

The Association of Government Accountants (AGA) is a member organization for financial professionals in government. AGA seeks to lead and encourage the change that benefits the field through training events, professional certification, publications, and ongoing education. AGA provides several government accounting resources to achieve their goal, including links to AGA programs, including training events and publications.

Three key resources we like from Association of Government Accountants (AGA):

Cost: Contact for membership dues price

40. American Accounting Association: Government and Nonprofit Section

@aaahq

The largest community of accountants in academia, the American Accounting Association (AAA) was founded in 1916. Viewed as though leaders in accounting, AAA members “shape the future of accounting through teaching, research and a powerful network.” The Government and Nonprofit (GNP) Section of AAA offers a variety of resources in order to promote that teaching and research for the government and not-for-profit communities.

Three key resources we like from American Accounting Association: Government and Nonprofit Section:

Cost:

Trainings, Videos, Webinars, and Workshops

41. AICPA National Governmental and Not-for-Profit Training Program

@AICPAconfs

October 19-21

New Orleans, LA

The 2015 AICPA Governmental and Not-for Profit Training Program will provide guidance on compliance, ethics, and governance issues specific to governmental and not-for-profit entities. Attendees will gain an awareness and comprehension of the latest regulatory changes, in order to be prepared to comply with the current rigorous standards. There are 29.5 possible CPE credits attached to the training, which is recommended for government accountants, auditors, controllers, CPAs in public practice, and others in government and not-for-profits.

Cost to attend: Early Bird Registration – By September 4

42. Accounting Academy: An Intensive Introduction to Governmental Accounting, Auditing, and Financial Reporting

@GFOA

August 3-7

Chicago, IL

This GFOA Accounting Academy is geared toward government accountants and auditors, especially those who are new to the public sector. Over the course of the intensive five-day workshop, government accountants will gain a solid understanding of the highly specialized rules, guidelines, and practices applicable to state and local governments. The GFOA Accounting Academy combines lecture, discussion, and exercises to address several areas including fund accounting, government-wide financial reporting, budgetary reporting, and many more. There are 32 CPE credits for this training.

Cost to attend:

43. Advanced Governmental Accounting

@GFOA

August 18-19

Minneapolis, MN

Advanced Governmental Accounting is a live training offered by the Government Finance Officers Association that offers 16 CPE credits. The training is best for government accountants and financial reporting professionals who have at least two years of experience, or who have attended the GFOA Intermediate Governmental seminar or an equivalent program. Attendees will take a detailed examination of selected governmental accounting topics, with an emphasis on the practical application of generally accepted accounting principles.

Cost to attend:

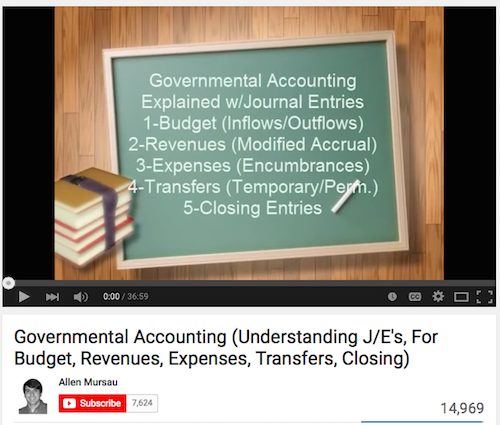

44. Governmental Accounting (Understanding J/E’s, For Budget, Revenues, Expenses, Transfers, Closing)

@amursau

Allen Mursau, CPA, has more than 7,600 subscribers to his YouTube channel, which has had more than 2,190,000 views since March 2012. In this Governmental Accounting video, Mursau explains governmental accounting in detail, through the lens of recording journal entries. With more than 14,900 views, this government accounting video is specific to governmental fund accounting is nearly 37 minutes long.

Three key topics we like from Governmental Accounting (Understanding J/E’s, For Budget, Revenues, Expenses, Transfers, Closing):

Cost: FREE

45. Governmental & Not-For-Profit Accounting: Professor Bora – Lecture #1

@RutgersU

@RBSExecEd

@irfanbora

In this government accounting video, Professor Irfan Bora, Director of the Rutgers online Master in Accountancy Program in Governmental Accounting, gives an overview of governmental accounting for state and local governments. The two-and-a-half hour lecture covers several governmental accounting topics, including the difference between operational and fiscal accountability, a comparison of the modified accrual basis of accounting and the accrual basis of accounting, government-wide and fun financial statements, and many others. For your convenience, the video lists discussion topics with time stamps so viewers can view the sections of the lecture that are of most interest to them.

Three key topics we like from Governmental & Not-For-Profit Accounting: Professor Bora – Lecture #1:

Cost: FREE

46. Governmental Accounting: Encumbrances and Expenditures

@_BetaAlphaPsi

Beta Alpha Psi is the international honor organization for accounting, finance, and information systems students and professionals. They offer several tutoring videos on YouTube, and their Governmental Accounting: Encumbrances and Expenditures video is a tutorial focusing on a problem explaining modified accrual accounting for governmental entities. The video is a suitable governmental accounting resource for government accounting students or those new to governmental accounting.

Three key topics we like from Governmental Accounting: Encumbrances and Expenditures:

Cost: FREE

47. Advanced Accounting – Governmental Accounting

@RutgersU

@RBSExecEd

Dr. Alexaner Kogan is a founder of Rutgers Accounting Web (RAW), the oldest and largest accounting website on the internet. RAW materials are available for use by accounting scholars, practitioners, educators, and students. In this government accounting video, Professor Kogan introduces governmental accounting and explains how the field uses the GASB method in his lecture.

Three key topics we like from Advanced Accounting – Governmental Accounting:

Cost: FREE

48. Nonprofit & Government: 13-2 Modified Accrual

@JGunyou

John Gunyou offers straightforward lessons and discussions regarding nonprofit and public finance in his government accounting videos on YouTube. With more than 40 years in the field, Gunyou shares observations that are “widely respected by citizens, bureaucrats and politicians alike, because he’s been there.” In this ten-minute government accounting video, Gunyou clearly explains modified accrual accounting using his entertaining style.

Three key ideass we like from Nonprofit & Government: 13-2 Modified Accrual:

Cost: FREE

49. How To Remember Fund Types For Governmental Accounting

@PedersonCPA

Rob Pederson, of Pederson CPA Review, offers courses to help people pass the CPA Exam using real-world examples from his nearly 20 years of experience. His governmental accounting video, How To Remember Fund Types For Governmental Accounting, is a nearly 12-minute video that demonstrates various ways to easily recall the various types of funds for governmental accounting.

Three key ideas we like from How To Remember Fund Types For Governmental Accounting:

Cost: FREE

50. Webinar – Intermediate Government Accounting

The Pennsylvania State Association of Boroughs (PASB) offers its Intermediate Government Accounting webinar for participants who have a working knowledge of governmental accounting. The webinar is designed for those professionals who need to be refreshed on GASB 34 basic concepts, capitalization of fixed assets, and GASB 54. This government accounting webinar is scheduled for September 17 at noon.

Three key topics we like from Webinar – Intermediate Government Accounting:

Cost:

51. Latest Developments in Governmental Accounting and Auditing 2015 (GVAA)

@SurgentCPE

Surgent, one of the nation’s leading providers of continuing professional education (CPE) for CPAs, offers this governmental accounting webinar, which will take place September 3 from 9am – 5pm. The webinar is designed for auditors and industry professionals working in the governmental environment who have a knowledge of government accounting and auditing.

Three key topics we like from Latest Developments in Governmental Accounting and Auditing 2015 (GVAA):

Cost: $219

52. Governmental Accounting and Reporting

@AICPAconfs

This AICPA government accounting workshop, moderated by Robert Smith, Jr., Ph.D., CPA, CCFM, is available both in text and on demand. A CPE course, Governmental Accounting and Reporting is intended for professionals who are familiar with basic state and local government accounting concepts and want to deeply examine the fundamentals, including how to prepare Agency Fund, Internal Service Fund, Investment Trust Fund, and Special Revenue Fund financial statements.

Three key topics we like from Governmental Accounting and Reporting:

Cost:

53. Governmental Accounting and Auditing Update

@AICPAconfs

The Governmental Accounting and Auditing Update follows a workshop format and is moderated by Lynda Dennis, CPA, CGFO, Ph.D. The workshop is suited to accounting and financial personnel who are responsible for accounting and financial reporting for governments and auditors for governments. Governmental Accounting and Auditing Update offers the latest information on governmental accounting and auditing requirements by helping participants analyze the recent GASB requirements and understand OMB Circular A-133 and Yellow Book requirements.

Three key topics we like from Governmental Accounting and Auditing Update:

Cost:

54. GASB Statement No. 68 Audit and Accounting Workshop

@AICPAconfs

This AICPA workshop focuses on GASB Statement NO. 68 and the way in which it “changes the playing field for governmental entities.” Moderated by Robert Scott, CPA, the workshop provides practical examples that illustrate the new accounting requirements to enhance government accountants’ understanding of the changes. Participants will work through case studies that address best practice solutions for auditing state and local governments with agent and cost-sharing plans.

Three key topics we like from GASB Statement No. 68 Audit and Accounting Workshop:

Cost:

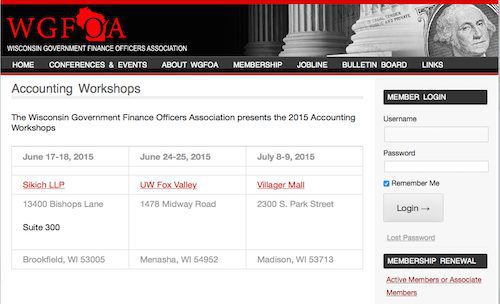

55. WGFOA 2015 Governmental Accounting Workshops

@sikichllp

June 17-18

Brookfield, WI

June 24-25

Menasha, WI

July 8-9

Madison, WI

The Wisconsin Government Finance Officers Association (WGFOA) presents three different opportunities to attend their 2015 government accounting workshops throughout the summer. These two-day workshops feature instructors Frederick G. Lantz, CPA, Partner-in-Charge, Government Services, Sikich LLP, and Marc DeVries, CPA, Director of Government Services – Wisconsin, Sikich LLP.

Three key topics we like from WGFAO Accounting Workshops 2015:

Cost:

56. Governmental Entities & GASB 34-35

@RealAssetMgmt

Alfred M. King, CFA, of Real Asset Management discusses the ins and outs of GASB 34 and what changes the new rule brings for government entities in this video. King notes that GASB 34 essentially means that governmental units are now required to do exactly what companies have been doing for 40 to 50 years.

Three key points we like from Governmental Entities & GASB 34-35:

Cost: FREE

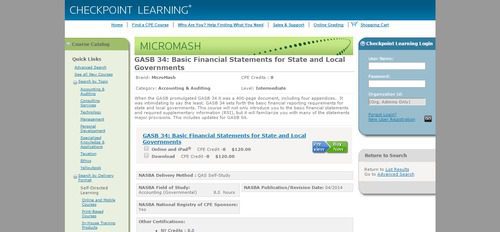

57. GASB 34: Basic Financial Statements for State and Local Governments

@CPETTaxAcctng

This online, self-study course offered by MicroMash through Checkpoint Learning offers 8 CPE credits. An intermediate-level course in accounting and auditing aims to simplify the 400-page GASB 34 document, providing students with essential information on requirements, implementation, and compliance.

Three things you’ll learn from GASB 34: Basic Financial Statements for State and Local Governments:

Cost: $120

58. GASB Basic Financial Statements for State and Local Governments

This webinar is offered by the West Virginia Society of Certified Public Accountants and offers 8 credits for attendees. “This course will build your understanding of GASB 34 and provide an update of GASB-related pronouncements, exposure drafts and future agenda items.” This webinar is designed for CPAs who serve government entities and are responsible for financial reporting, in addition to government officials responsible for preparing financial statements.

Key objectives for GASB Basic Financial Statements for State and Local Governments:

Cost:

Asset Tracking Solutions from Camcode:

Our sales engineers are experts in automatic asset tracking, tagging and identification,a nd can answer all your questions. Get in touch now.

Lets Talk ›